News from our Neighbors

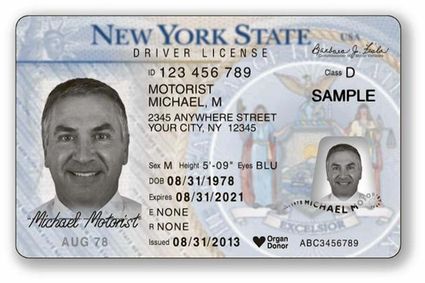

The laser-engraving and rigidness are among 30 security features built into the new cards, officials say.

NYS DMV INTRODUCES NEW DRIVER LICENSE AND NON-DRIVER ID DOCUMENTS

New York driver’s licenses have gotten a makeover. The Department of Motor Vehicles, looking to crack down on counterfeiting, is rolling out a new, high-tech license that tones down the color and ramps up the security.

The new design, which contains more than 30 security features, places them among the most secure of their kind in the country. The most apparent change in the documents is that the photos and personal data are laser engraved into the document rather than printed on them making the documents counterfeit and tamper resistant. The laser engraved photo also has a “grayscale” appearance that offers superior resolution for photo comparison purposes. Another change is that the license for those under 21 will be vertical rather than horizontal. Motorists who used the DMV’s website to renew or obtain a new license will receive this new design and all DMV offices in the state will have the new licenses by the end of September.

CONSUMER ALERT: THE GROWING TREND OF CHILD-IDENTITY THEFT

Albany, NY (August 14, 2013) Governor Andrew M. Cuomo alerted parents, guardians and young adults about a growing trend of child identity theft. These victims may not discover their identities have been stolen until they begin applying for loans, credit card accounts, or renting their first apartment.

Child identity theft is the assumption of an identity through the use of a minor’s personal information and social security number. Once this information is attained, the thief will use it to create a false identity. Then the false identity will often be used to obtain credit cards, open new utility accounts, or make large purchases such as a car or home. Subsequently, the child victim is left with damaged credit that frequently remains undetected for years.

The New York State Division of Consumer Protection is advising the public to remain vigilant with their personal information and to take the following precautions to make sure theirs and their children’s identities are not compromised:

Obtain a credit report with your child’s personal information by contacting the three credit agencies. If any activity is detected, immediately file an identity theft complaint with your local police and report findings with the three credit agencies.

• Equifax: 1-800-525-6285

• Experian: 1-888-397-3742

• Trans Union: 1-800-680-7289

The Fair Credit Reporting Act (FCRA) requires each of these nationwide credit reporting companies to provide consumers with a free copy of their credit report, at their request, once every 12 months. To order, consumers can go to http://www.annualcreditreport.com or call 1-877-322-8228.

Be aware of any suspicious mail addressed to your child. If any credit card offers or debt collection materials contain your child’s name, contact each credit reporting agency immediately as it might be a sign of identity theft.

If your child is headed to college or moving out on his or her own, request a copy of his or her credit report in advance to verify the information is accurate.

If a young adult in your household receives pre-approved credit offers, it is important that he or she shred any unwanted mail. Identity theft rates are highest amongst students ages 18 to 24.

Be careful in providing children’s personal identifying information for after-school activities, tutoring or sports team/ club participation. If asked for a social security number, inquire why is it needed? Isn›t there another way to identify my child? How will my child›s information be protected? Only reveal your child›s Social Security number if you have no other option.

Talk to your child about the importance of Internet safety, identify what information is personal to your child and work with your child to create the life-long habit of securing his or her personal information.

In March of this year, Carnegie Mellon’s CyLab reported that children are 51 times more likely than adults to be victims of identity theft.

For further information about child identity theft or to file a complaint, please contact the New York Department of State’s Division of Consumer Protection at (518)-474-8583 or visit our website at http://www.dos.ny.gov.

PARENTS PROJECTED TO SPEND $241,080 TO RAISE A CHILD BORN IN 2012, ACCORDING TO USDA REPORT

WASHINGTON, August 14, 2013 - The U.S. Department of Agriculture (USDA) released its annual report, Expenditures on Children by Families, also known as the Cost of Raising a Child. The report shows that a middle-income family with a child born in 2012 can expect to spend about $241,080 ($301,970 adjusted for projected inflation*) for food, shelter, and other necessities associated with child-rearing expenses over the next 17 years. This represents a 2.6 percent increase from 2011. Expenses for child care, education, health care, and clothing saw the largest percentage increases related to child rearing from 2011. However, there were smaller increases in housing, food, transportation, and miscellaneous expenses during the same period. The 2.6 percent increase from 2011 to 2012 is also lower than the average annual increase of 4.4 percent since 1960.

The report, issued annually, is based on data from the Federal government›s Consumer Expenditure Survey, the most comprehensive source of information available on household expenditures. For the year 2012, annual child-rearing expenses per child for a middle-income, two-parent family ranged from $12,600 to $14,700, depending on the age of the child.

The report, developed by the USDA Center for Nutrition Policy and Promotion (CNPP), notes that family income affects child-rearing costs. A family earning less than $60,640 per year can expect to spend a total of $173,490 (in 2012 dollars) on a child from birth through high school. Middle-income parents with an income between $60,640 and $105,000 can expect to spend $241,080**; and a family earning more than $105,000 can expect to spend $399,780.

«One of the major expenses on children is food,» said CNPP Acting Executive Director Robert Post, Ph.D.

Hoping to crack down on underage drinking, the DMV is also issuing licenses to drivers under 21 that are printed vertically, like playing cards, instead of horizontally, like traditional licenses.

Expenses per child decrease as a family has more children. Families with three or more children spend 22 percent less per child than families with two children. As families have more children, the children can share bedrooms, clothing and toys can be handed down to younger children, food can be purchased in larger and more economical quantities, and private schools or child care centers may offer sibling discounts.

Reader Comments(0)